AboutWhat is Georgia

It is a country with a short history that became independent from the former Soviet Union in

1991.

The population is about 3.7 million. However, it is said that about 9 million (2018)

foreign tourists visit annually and increase to 15 million by 2020.

In fact, it is a big IT country and

most administrative procedures are available online! and because the corporate tax is as low as

15%, venture companies all over the world have established corporations in Georgia in recent

years.

The birthplace of wine, Cleopatra also loved Georgia wine, and the Georgia wine that has

spread from Georgia to far Egypt is also known as "Cleopatra's Tears".

Tax SystemCorporate tax structure in Georgia

The corporate tax rate announced by the Government of Georgia is 15%. (Data from June 2019) However, in the case of a corporationthat actually does business only,the corporate tax is 0% in Georgia.

What does this mean?

This is because the corporate tax in Georgia

uses the

Estonian

method.

What is the Estonia method?

Corporate income tax is zero if no dividends are paid. It is zero as long as internal reservations continue. Taxes are subject to dividends. This is the Estonia method.

In particular...

When a corporation conducts business activities:

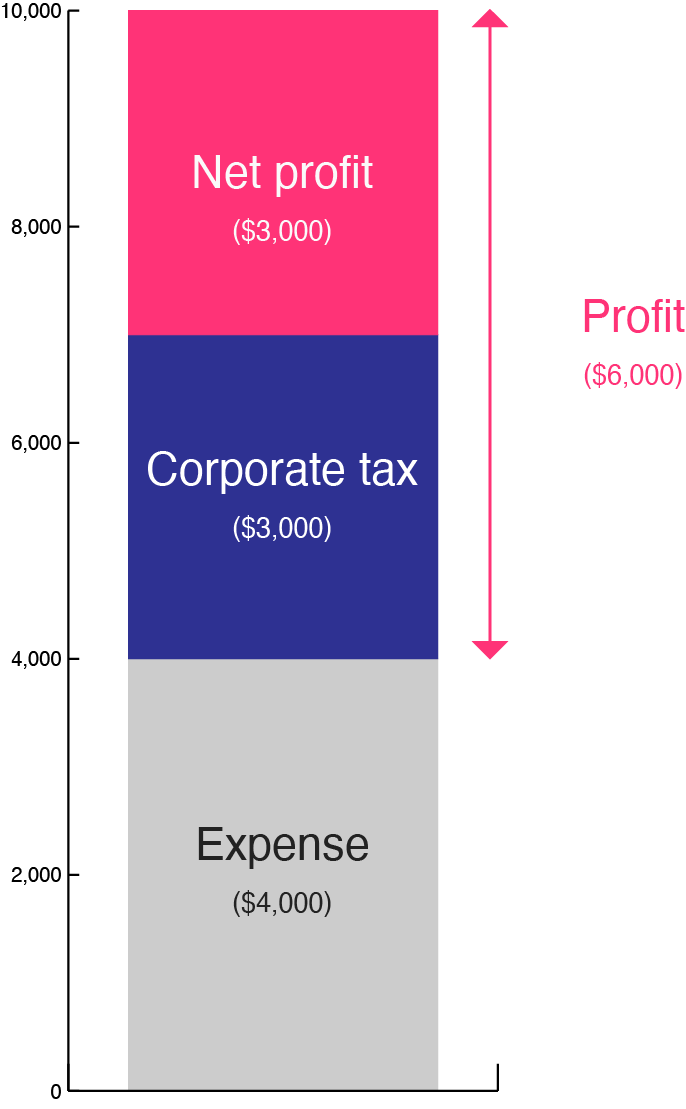

| Corporate tax | 50% |

| Sales | $10,000 |

| Expenses (such as purchasing costs and advertising costs) | -$4,000 |

| Profit | +$6,000 |

General case

A corporate tax is generated on the profit of 6,000 dollars, a corporate tax of 3,000 dollars is paid, and a final 3,000 dollars remains in the hands of the corporation

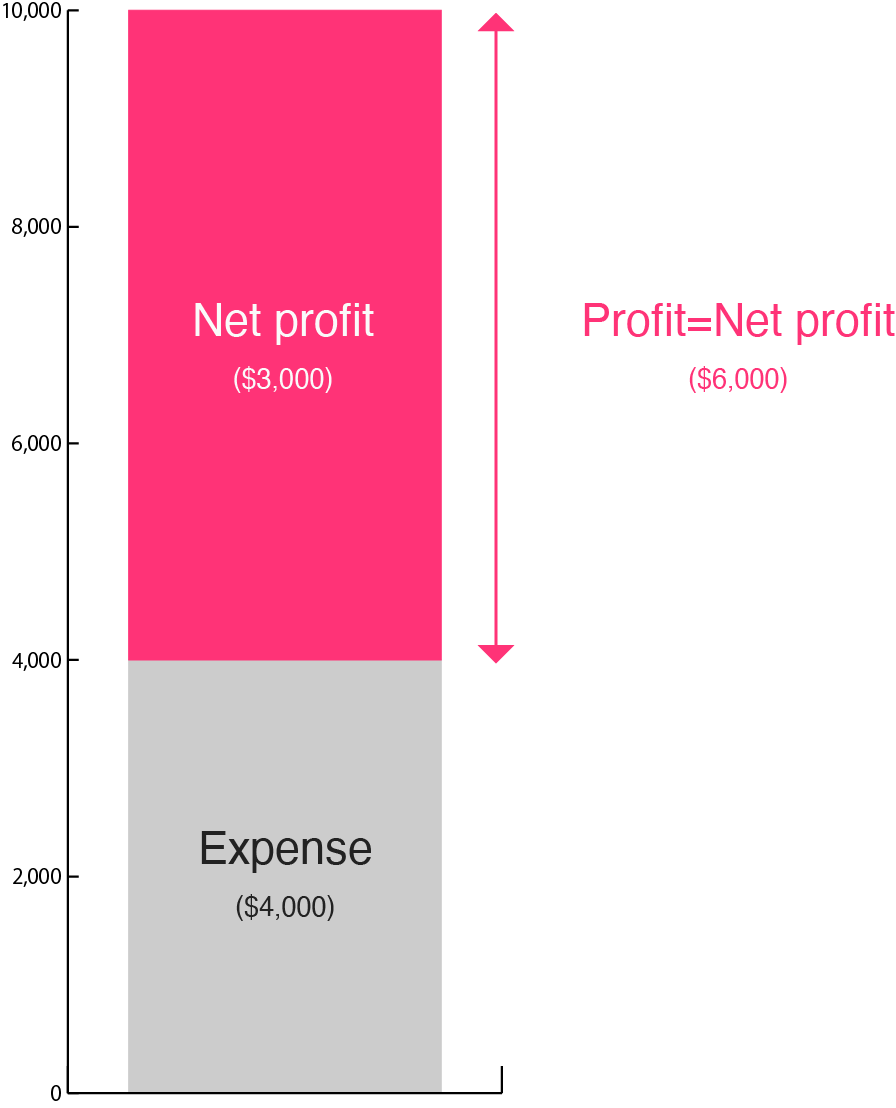

For Georgia

There is no corporate tax on the profit of $6,000, and $6,000 remains as corporate profit, and can be used in business activities the following year.

So when will 15% corporate tax

occur in Georgia?

Profit distribution

Suppose you decide to pay out $500,000 of the $1 million profit to shareholders. In this case, a corporate tax of 15% is incurred for $500,000, and the corporate tax of $75,000 must be paid immediately. So if you want to pay a $500,000 dividend to a shareholder from a $1 million profit, This means that you can only pay a dividend of $500,000 after paying a corporate tax of $75,000.

Expenses incurred have nothing to do with economic activity

For example, although only “Real estate” is clearly stated in the business activities of the Articles of Incorporation, For example, if the amount of money spent at an amusement park is $100,000, which has nothing to do with business, that $100,000 is not related to economic activity. Immediate payment of 15% of $100,000 and corporate tax of $15,000 is required.

Free gift

For example, a company that sells cars has 100 inventories and an asset value of $1 million. If this stock is given free of charge to other companies and individuals, if the asset value is $1 million, 15% of $1 million and $150,000 of corporate tax must be paid immediately. This includes not only the inventory that a company has, but also the transfer of funds. (The act of transferring money or securities to a third party free of charge)

Expenses of company representatives exceeding the limit

Personal representative expenses can also be accounted for as business requirements, but there is a limit, which is up to 1% of the company's total revenue. In other words, if the amount exceeding 1% is $100,000, it is necessary to immediately pay the corporate tax of 15% or $15,000 for that $100,000.

These are the rules that you must pay corporate tax,

but conversely, Georgia does not

have to pay corporate tax

if it does not fall under Rules 1 to 4.

* Nominee is a system that prevents your name from appearing in registration documents when you establish an overseas subsidiary. Originally, directors and shareholders of overseas corporations are registered as well as Japanese corporations. However, if you are a Georgia corporation, you can use a nominee to rent a name from a foreigner and register your company.

Corporate tax 0% if you follow the rules

In the case of a corporation that actually does business only, the corporate tax is 0%.

No capital required when establishing a corporation

When establishing a corporation in Georgia, it is OK even if the capital is zero.

Foreigners are OK

When establishing a corporation in Georgia, foreigners can be shareholders and representatives.

No office needed

When you establish a corporation in Georgia, you can also use a virtual office.

Nominee is OK

When establishing a corporation in Georgia, shareholders / representatives are fine even in Nominee.

Establishment of corporation is fine by mail

When establishing a corporation in Georgia, everything is fine by mail.

MeritBenefits of establishing a corporation in Georgia

The corporate tax rate announced by the Government of Georgia is 15%.(Data from June 2019)

However,

in the case of a corporation that actually does business only,

the corporation tax is 0% in Georgia.

* Nominee is a system that prevents your name from appearing in registration documents when you establish an overseas subsidiary. Originally, directors and shareholders of overseas corporations are registered as well as Japanese corporations. However, if you are a Georgia corporation, you can use a nominee to rent a name from a foreigner and register your company.

ApplicationThis is a corporation in Georgia

that is attracting worldwide attention.

And Beograd Consulting Group decided to

establish a corporation in Georgia

Established as a shareholder nominee

Opened corporate account of the largest private bank listed in Georgia listed in London

These are fully supported as a set!

Application

If you wish to support the establishment of a corporation in Georgia,

please apply after

entering the following.

※ Credit Card (VISA, MASTER, JCB, AMEX, DINERS)Available.